cumulative preferred stock meaning

Ad Power Your Trading with thinkorswim. This preferred stock feature assures the owner that any omitted dividends on this stock will be made up before the common stockholders will receive a dividend.

Preferred Dividend Definition Formula How To Calculate

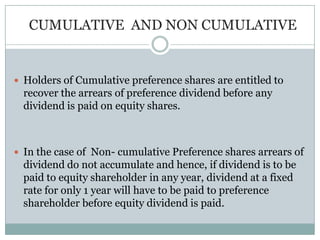

All preferred dividends in arrears must be paid before common stockholders can receive distributions.

. Check out our free Preferred Stocks Primer before you buy. Cumulative Preferred Stocks are a type of preferred stock that abides the company to pay all the dividends for this type of shareholders before paying any other shareholder of the company. If a company misses a dividend payment for any reason it still owes it to cumulative preferred stockholders.

Cumulative preferred stock is a type of preferred stock for which any omitted dividends must be paid before the corporation is allowed to pay a dividend on its shares of common stock. Safe Preferred Stock means the shares of a series of Preferred Stock issued to the Investor in an Equity Financing having the identical rights. Class C Preferred Stock means the Issuers Preferred Stock Series C.

Participating preferred stock is a type of preferred stock that gives the holder the right to receive dividends equal to the normally specified rate that preferred. 2 days agoDividends on the Series A Preferred Stock and Series B Preferred Stock are cumulative and payable monthly on the 15 th day of each month. Cumulative Preferred Stocks are a type of preferred stock that abides the company to pay all the dividends for this type of shareholders before paying any other shareholder of the company.

Dividends on the cumulative preferred stock must be paid out before any dividends are paid to. Cumulative preferred stock definition. Preferred shares generally have a dividend that.

Therefore the amount. Ad Search Ex-Dividend Dates Dividend Calendar All-Star Rankings More. Related to 6 Cumulative Preferred Stock.

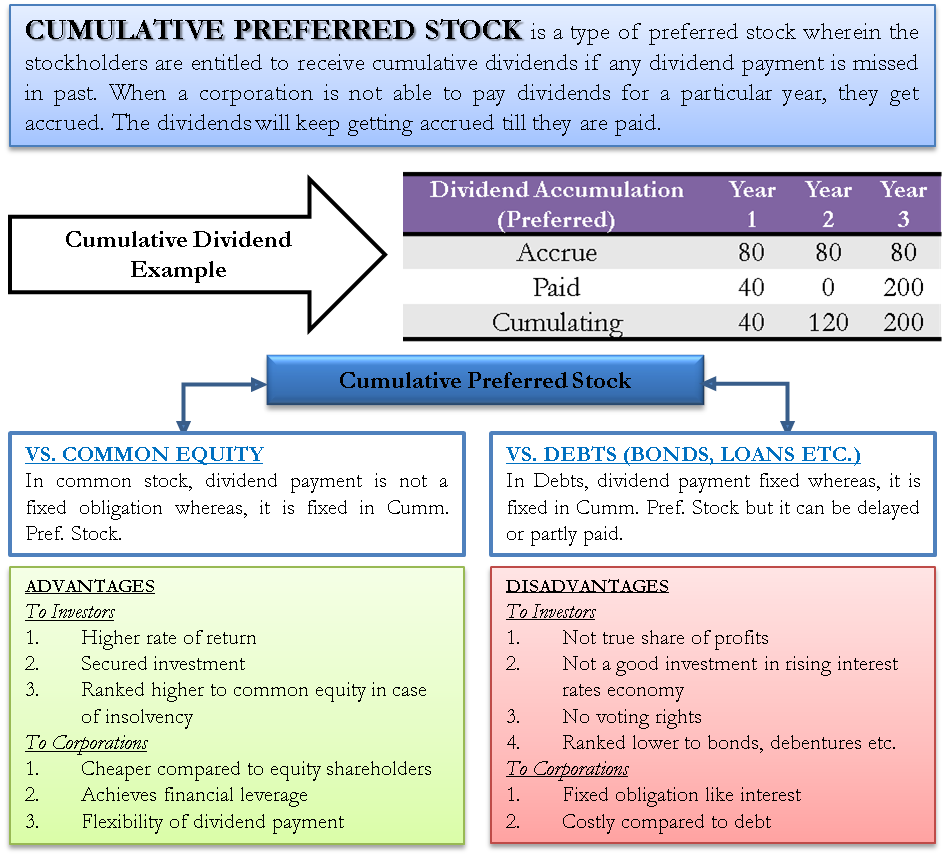

Cumulative preferred stock is an equity instrument that pays a fixed dividend on a predetermined schedule and prior to any distributions to the holders of a companys common stock. A cumulative preferred stock is a type of preferred stock wherein the stockholders are entitled to receive cumulative dividends if any dividend payment is missed in past. This means that the company is supposed to pay all the dividends including the ones that were previously not paid out to these cumulative.

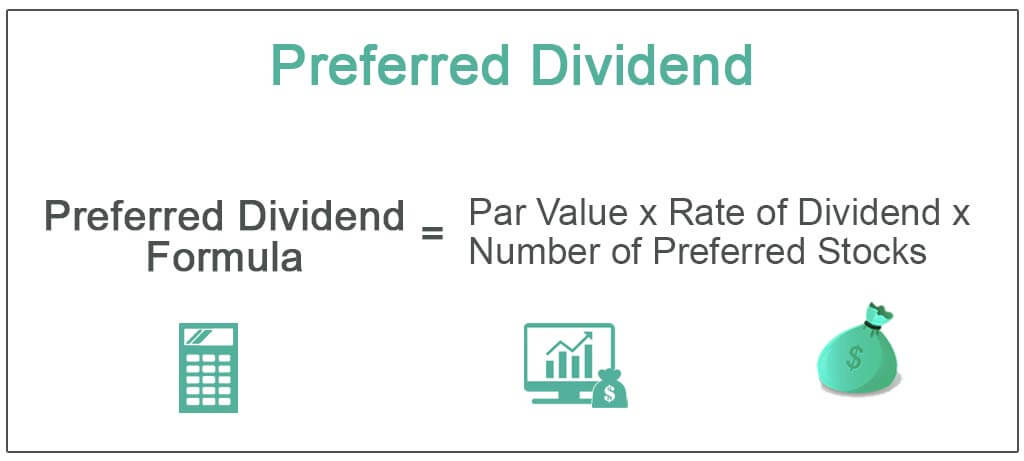

It also has ordinary shares worth 5 million. Thus a 5 dividend on preferred shares that have a 100 par value equates to a 5 dividend. The amount of the dividend is usually based on the par value of the stock.

Preferred stocks typically have fixed dividend payments based on the stocks par value. It successfully paid up dividends for 2019 and 2020. A cumulative preferred stock is a type of preferred stock that requires the company to make up for any missed dividend.

In other words its a type of preferred stock that has a right to a specific amount of dividends each year. This means that shareholders do not have a claim on any of the dividends that were not paid out. Preferred stock for which the publicly-traded company must pay all dividends.

Ad Free Preferred Stocks Primer. Find Todays Best Dividend Stocks Ex-dividend Dates and Stock Data. Switch to new thesaurus.

A perpetual preferred stock is a type of preferred stock that has no maturity date. Meaning that this kind of stock has less fluctuation in price than common. Meaning Characteristics Advantages Criticisms and More Plowback.

Provided that if any dividend payment date is not a. This means that the company is supposed to pay all the dividends including the ones that were previously not paid out to these cumulative. Top Dividend Paying Stocks.

Cumulative preferred stock contains a provision requiring that any missed dividend payments be paid out to. Any omitted dividends on cumulative preferred stock are referred to as dividends in arrears and must be disclosed in the notes to the financial. Class A Preferred Stock means the Class A Preferred Stock par value 01 per share of the Corporation.

Typically the corporations board of directors will not declare a dividend they will be omitting. Assume 10000 shares of 10 par 8 cumulative preferred stock has not paid dividends from 112004 to 12312007. Dividends are paid out regularly such as quarterly or annually.

The issuers of perpetual preferred stock will always have redemption privileges on. However due to some errors in production the company made a loss. If the dividends arent declared or paid the stock can accumulate the unpaid dividends for a future date when they are declared.

A preferred stock is a class of ownership in a corporation that has a higher claim on its assets and earnings than common stock. ABC has a 10 cumulative preferred stock at 1 each valued at 1 million in 2019. Cumulative preferred stock - preferred stock whose dividends if omitted accumulate until paid out.

Definition of Cumulative Preferred Stock. Perpetual Preferred Stock. Cumulative preferred stock is a class of stock that where undeclared dividends are allowed to accumulate until they are paid.

That is all dividends that were skipped must be paid to cumulative preferred stockholders before any dividends are paid to common stock holders. Three Cutting-Edge Platforms Built For Traders. By implication the company will pay a 100000 dividend every year that is 10100 x 1000000.

Noncumulative preferred stock allows the issuing company to skip dividends and cancel the companys obligation to eventually pay those dividends. Find out preferred dividends paid in each year and the amount if any available for distribution to common stockholders. When a corporation is not able to pay dividends for a particular year they get accrued.

If net income for the 2015 2016 and 2017 were 45 million 85 million and 10 million. Preference shares preferred shares preferred stock - stock whose holders are guaranteed priority in the payment of dividends but whose holders have no voting rights. Usually the issuing company cannot issue dividends to the holders of its common stock in the same year in which it has.

The preferred stock is cumulative. At the end of 2007 the cumulative dividend not paid is 32000 100000 8 4 years. As referenced above cumulative preferred stock is a type of preferred stock.

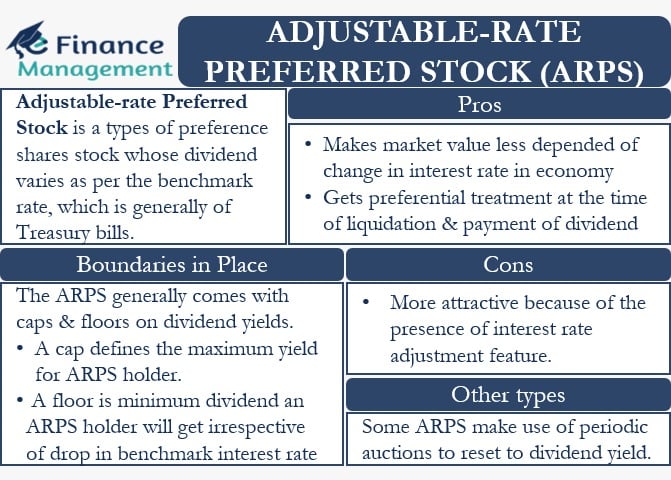

Adjustable Rate Preferred Stock Meaning Pros Cons And More

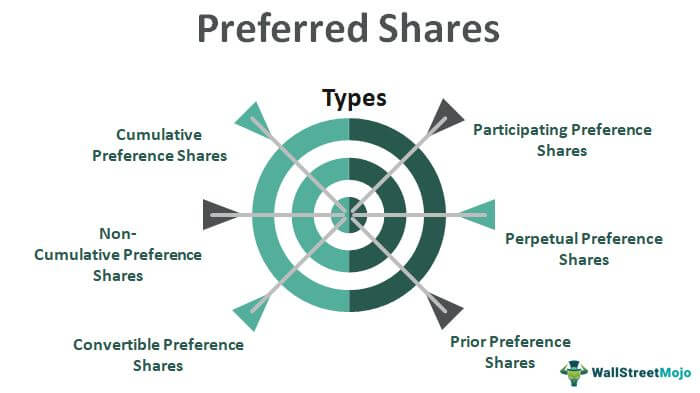

Preferred Shares Types Features Classification Of Shares

Preferred Shares Meaning Examples Top 6 Types

Preferred Shares Meaning Examples Top 6 Types

Cumulative Preferred Stock Definition Business Example Advantages

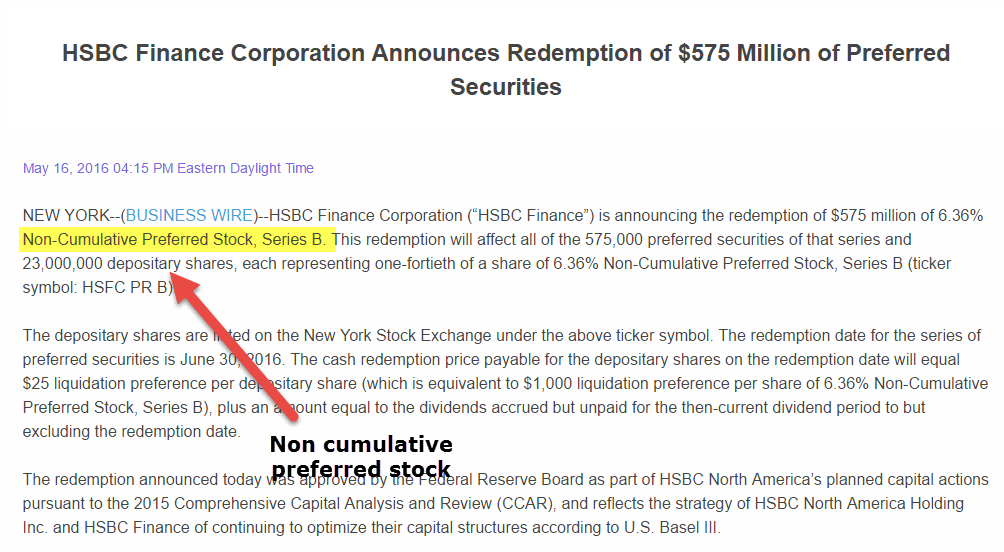

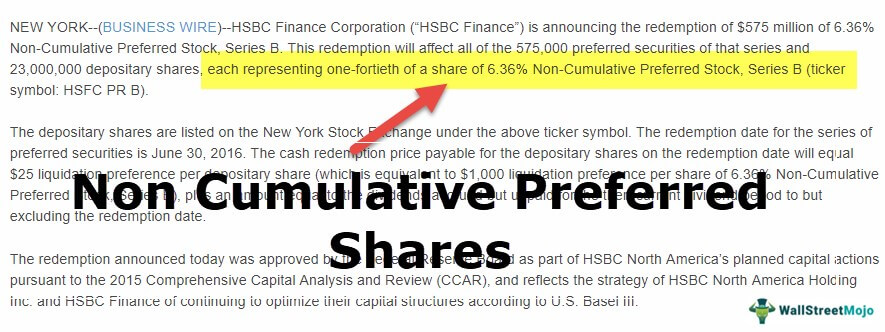

Noncumulative Preference Shares Stock Top Examples Advantages

Preferred Shares Meaning Examples Top 6 Types

Objectives Discuss The Features Of Both Common And Preferred Stock Ppt Video Online Download

Common Stock Vs Preferred Stock A Guide Equitynet

Common Shares Vs Preferred Shares Comparison Of Equity Types

Cumulative Preference Shares Meaning Best Example 2021

Cumulative Preferred Stock Definition

What Is Preferred Stock 2022 Robinhood

Cumulative Preferred Stock Define Example Benefits Disadvantages

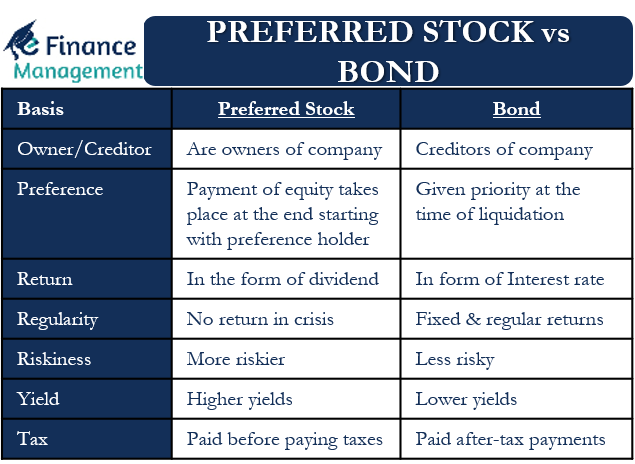

Preferred Stock Vs Bond Meaning Differences And More Efm

Difference Between Cumulative And Non Cumulative Preferred Stocks Ask Any Difference